The better the results, the higher the expectations. Impressive prior corporate earnings seasons have raised the bar so high that S&P 500 companies find it extremely difficult to meet it. Only 76% of reporting issuers beat Wall Street earnings estimates — the same share beat on revenue. The first figure is the weakest in three quarters, the second — the worst in four.

Markets punish companies harshly when actual results fail to meet forecasts. A 0.5 percentage?point drop in a stock after its results is larger than the decline in the S&P 500 itself. That is the first negative reading of this indicator in two years.

S&P 500 Companies Beating Estimates and Market Reactions

A notable example is the market's reaction to disappointing Microsoft results. The company reported higher AI infrastructure costs and slower cloud growth. As one of four issuers with market caps above $3 trillion, a 10% drop in Microsoft shares predictably dragged the S&P 500 down.

This was Microsoft's largest percentage decline since the pandemic. The $357 billion one?day hit to market value set an anti?record for the issuer and was the second?largest one?day loss on record for any company worldwide.

The Microsoft?triggered S&P 500 sell?off allowed investors to deploy a familiar tactic: they bought the dip. The trade rests on confidence in a strong US economy, a resumption of the Fed's easing cycle and support from the White House. Together these form a safety buffer for the S&P 500, although vulnerabilities remain.

In particular, the likelihood that Kevin Warsh will become the new Fed chair is high. Historically, he has shown hawkish tendencies as an FOMC governor. In theory, that could push back the timing of any easing cycle and hurt equities. On the other hand, a Fed led by Warsh could preserve institutional independence, which would be good news for US stocks.

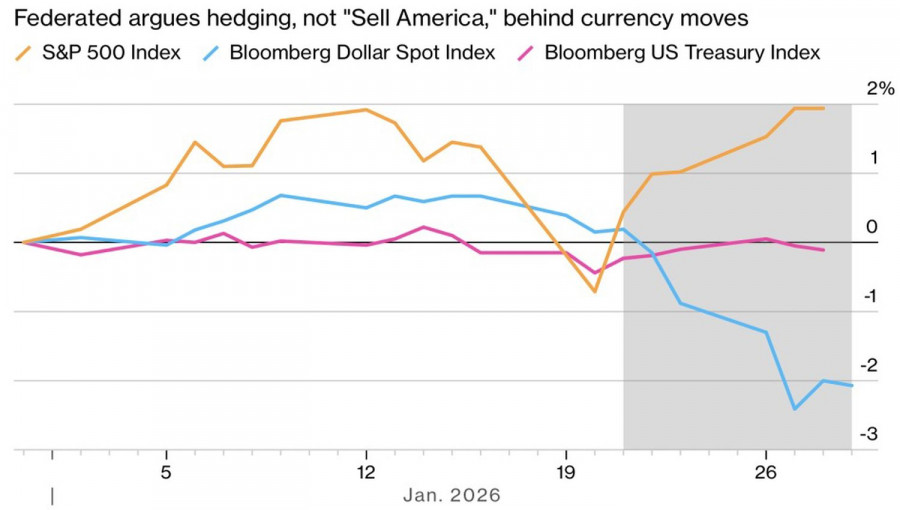

Dynamics of S&P 500, USD, and US Bonds

The biggest beneficiary of this scenario would be the US dollar. The recent dollar selling was driven largely by non?resident hedging of currency risk on US securities. If the Fed's independence is not at risk, those hedges can be unwound.

Earnings season continues. Investor attention is shifting to other Magnificent Seven companies that can move the broad index materially.

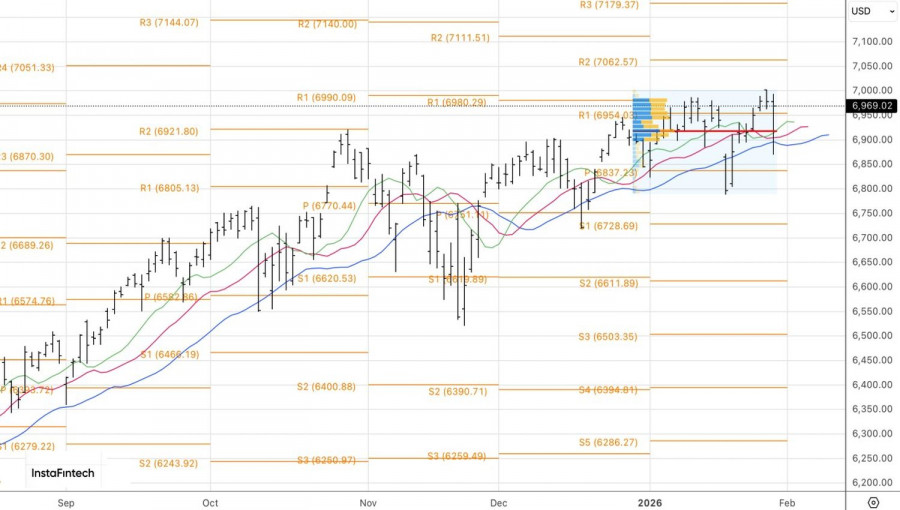

Technically, the daily chart shows that the S&P 500 has formed a pin?bar with a long lower wick. That indicates bear weakness and provides an opportunity to place a buy?stop near the high at 6,991. Activation of that order would allow traders to add to existing long positions with targets at 7,060 and 7,140.