The EUR/USD pair is seeing an inflow of new sellers after yesterday's struggle and is retesting levels just below the round 1.1900 level. Nevertheless, spot prices have recovered about 25 points from the daily low and are currently trading around 1.1920–1.1925, showing a daily decline of 0.35%. The US dollar is gaining momentum and is likely to continue rebounding from the four-year low recorded earlier this week. At the same time, the European Central Bank is concerned about the rapid rally of the euro against the US dollar, which has further increased pressure on the EUR/USD pair.

The US dollar is gaining momentum and is likely to continue rebounding from the four-year low recorded earlier this week. At the same time, the European Central Bank is concerned about the rapid rally of the euro against the US dollar, which has further increased pressure on the EUR/USD pair.

From a technical perspective, intraday weakness below the 100-hour simple moving average (SMA) acts as a new bearish signal for EUR/USD. However, it is worth noting that spot prices have shown resilience below the round 1.1900 level and have rebounded from it.

Meanwhile, the Moving Average Convergence/Divergence (MACD) line is moving below the signal line into negative territory, while the shrinking negative histogram highlights fading bullish momentum. The Relative Strength Index (RSI) is holding around 40, reinforcing a consolidation bias and calling for caution before positioning for further downside in EUR/USD.

At the same time, it should also be noted that oscillators on the daily chart remain positive, indicating that the bulls are still in control of the situation. If the pair breaks above the 1.1975 level, it could move toward the round 1.200 level and challenge the January high.

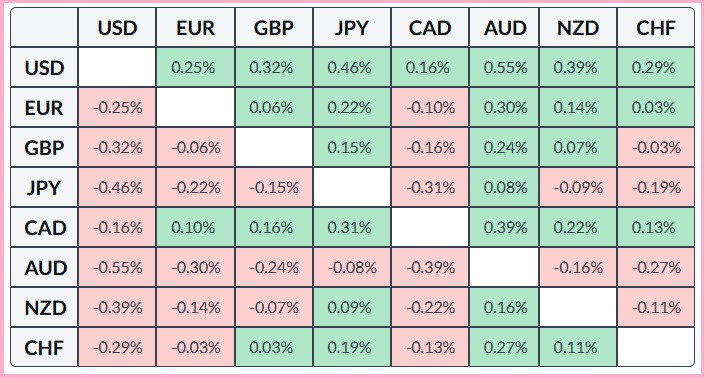

The table below shows the percentage changes of the US dollar against major currencies at the moment. The dollar has demonstrated strength against the Australian dollar.

QUICK LINKS