Prodej nových vozů Tesly v Norsku v květnu vzrostl o 213 % oproti loňskému roku na 2 600 vozů, jak vyplývá z údajů o registracích zveřejněných v pondělí. K tomuto nárůstu přispěl přepracovaný kompaktní SUV Model Y, který je již třetím rokem nejprodávanějším automobilem v zemi.

Prodej od začátku roku vzrostl o 8,3 % oproti prvních pěti měsícům roku 2024.

Devět z deseti nových automobilů prodaných v Norsku v loňském roce byly plně elektrické vozy a podíl elektromobilů na prodeji od začátku roku činí 92,7 %, uvedla Norská silniční federace, čímž se země přiblížila cíli postupného vyřazení dieselových a benzínových automobilů.

Společnost Tesla (NASDAQ:TSLA), která letos v Evropě zaznamenala pokles prodeje v důsledku podpory krajně pravicové politiky ze strany generálního ředitele Elona Muska, nabízí v Norsku a několika dalších zemích bezúročné půjčky kupujícím, kteří si do konce června pořídí nový model Y.

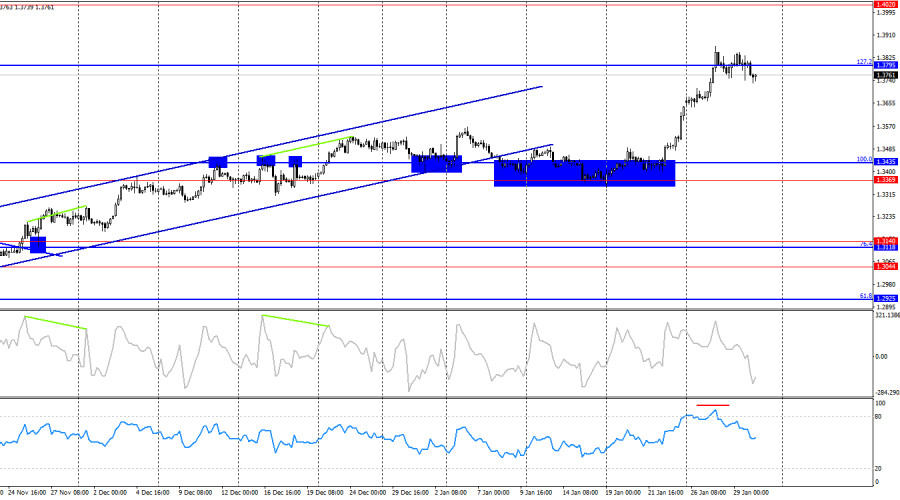

On the hourly chart, the GBP/USD pair on Thursday rebounded from the 1.3845 level and fell to the 161.8% corrective level at 1.3755. Then there was another decline to 1.3755 followed by a rebound from this level. Thus, horizontal movement may continue today, while local growth may develop toward the 1.3845 level. A consolidation of quotes below 1.3755 will allow traders to expect a continuation of the decline toward the support level of 1.3611–1.3620.

The wave situation remains "bullish." The last completed downward wave did not break the previous low, and the new upward wave broke the previous peak. The news background for the British pound has been weak in recent months, but the informational background in the United States is even worse. Donald Trump regularly provides support to the bulls, which ensures growth of the British currency. A break of the current trend can only be determined after two consecutive "bearish" waves.

The news background on Thursday was virtually absent, but the market is waiting for a resolution of the situation with Iran. Let me remind you that Donald Trump has effectively announced new missile strikes on the Middle Eastern country, as Tehran refused to agree to nuclear disarmament. In addition, since December last year the country has been swept by mass protests and riots among the population demanding the resignation of the current government. Trump called the protesters "brave people" and is ready to provide them with all possible support in their struggle against a hostile regime. If in the coming days Trump orders an attack on Iran, the dollar may show additional growth, as geopolitical tensions will once again escalate. At the moment, we see that the bears cannot even close below the 1.3755 level, which is the nearest support after the strong rise of the pound. There are practically no economic events on the UK and US calendars today, so attention should be paid to news from the White House and the Middle East.

On the 4-hour chart, the pair rose to the Fibonacci level of 127.2% at 1.3795 and rebounded from it. Thus, in the coming days we may observe some decline toward the support level of 1.3369–1.3435. A consolidation of the pair above 1.3795 will allow expectations of a continuation of the bullish trend toward the 1.4020 level. No emerging divergences are observed today, but the RSI indicator is overbought, which may trigger a corrective pullback.

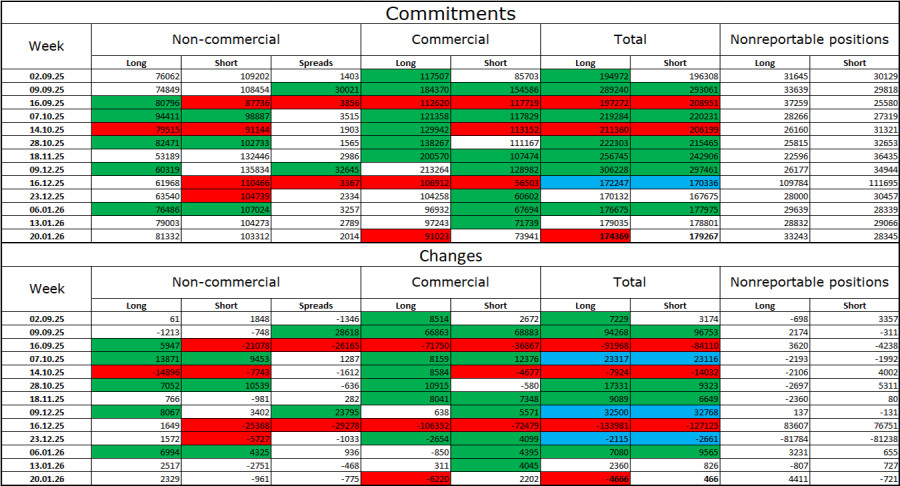

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became more bullish over the last reporting week. The number of long positions held by speculators increased by 2,329, while the number of short positions decreased by 961. The gap between the number of long and short positions is now effectively as follows: 81 thousand versus 103 thousand, and it is narrowing rapidly. Bears have dominated in recent months, but it seems they have exhausted their potential. At the same time, the situation with euro currency contracts is exactly the opposite. I still do not believe in a bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the US currency may periodically enjoy demand in the market. But not in the long term. Donald Trump's policies have led to a sharp decline in the labor market, and the Federal Reserve is forced to pursue monetary easing in order to stop the rise in unemployment and stimulate the creation of new jobs. US military aggression also does not add optimism for dollar bulls.

News calendar for the US and the UK:

USA – Producer Price Index (13:30 UTC).

On January 30, the economic calendar contains only one entry that does not generate any interest. The influence of the news background on market sentiment on Friday will be absent.

GBP/USD forecast and trading advice:

Selling the pair was possible after a rebound from the 1.3845 level on the hourly chart with targets at 1.3755 and 1.3620. The first target was achieved. New sell positions can be opened after a close below 1.3755 with a target of 1.3611–1.3620. Buy positions can be opened on a rebound from the 1.3755 level with targets at 1.3845 and 1.3931.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2026-01-30 08:21:36 IP: 172.18.0.1