Ázerbájdžánská státní energetická společnost SOCAR brzy podepíše nové dohody o průzkumu ropy a zemního plynu v Ázerbájdžánu, mimo jiné s Exxon Mobil a BP, uvedly v pondělí tři zdroje agentuře Reuters.

Zdroje, které hovořily pod podmínkou anonymity, odmítly poskytnout další podrobnosti.

Podle amerického ministerstva energetiky má Ázerbájdžán prokázané zásoby ropy ve výši 7 miliard barelů a prokázané zásoby zemního plynu ve výši 1,7 bilionu kubických metrů.

Ázerbájdžán plánuje do roku 2030 zvýšit vývoz zemního plynu o celkem 8 miliard kubických metrů (bcm), uvedl v pondělí prezident Ilham Alijev.

Dodatečné objemy budou těženy z pěti stávajících a nových ložisek, uvedl Alijev.

Ázerbájdžán vyvezl v roce 2024 25 bcm zemního plynu.

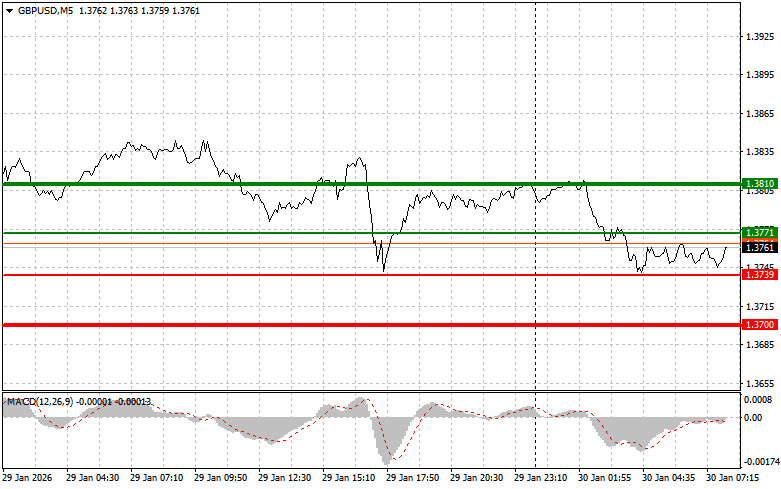

The test of the price at 1.3804 coincided with the moment when the MACD indicator was beginning to move upward from the zero mark, confirming the correct entry point for buying the pound. As a result, the pair reached the target level of 1.3832.

Weak data, including the increase in the negative trade balance of the US and the rise in unemployment claims in the US, limited demand for the US dollar, although they did not lead to a significant increase in the pound. It is evident that the influence of negative economic data on the dollar was noticeable but not catastrophic. The increase in the negative trade balance raises many more questions, especially considering Trump's trade policies, which apply pressure on the dollar. This trend could worsen if American consumers continue to actively purchase imported goods, while exports from the US remain at previous levels.

Given that there are again no reports from the UK today, the pair may continue to decline. The absence of economic news from the United Kingdom shifts focus to other macroeconomic factors and market sentiment. Without fresh data confirming the resilience of the British economy, traders may exercise caution, potentially leading to capital outflows from the British pound.

Regarding the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching an entry point around 1.3771 (green line on the chart), targeting a move to 1.3810 (thicker green line on the chart). At around 1.3810, I intend to exit my long positions and open short positions in the opposite direction (expecting a movement of 30-35 pips back from that level). One can expect the pound to grow today, in line with the trend. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the price at 1.3739 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. One can expect growth towards the opposite levels of 1.3771 and 1.3810.

Scenario #1: I plan to sell the pound today after the 1.3739 level (red line on the chart) is updated, which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3700 level, where I intend to exit my short positions and immediately open long positions in the opposite direction (expecting a move of 20-25 pips back from that level). Sellers of the pound will likely seize any opportunity. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the price at 1.3771 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. One can expect a decline to the opposite levels of 1.3739 and 1.3700.

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2026-01-30 10:05:11 IP: 172.18.0.1