USA zrušily dotace na 24 projektů v oblasti zelené energie, které byly schváleny během vlády prezidenta Joea Bidena a jejichž celková hodnota přesáhla 3,7 miliardy dolarů, včetně projektu v rafinérském komplexu Exxon v Texasu, oznámilo v pátek ministerstvo energetiky.

Administrativa prezidenta Donalda Trumpa uvedla, že vyhodnocuje dotace a půjčky z veřejných zdrojů poskytnuté projektům v oblasti nových technologií během Bidenovy administrativy. Děje se tak v době, kdy Trumpova administrativa usiluje o maximalizaci již tak rekordní těžby ropy a zemního plynu a zároveň ruší řadu Bidenových opatření v oblasti klimatu a čisté energie.

Granty Úřadu pro demonstraci čisté energie na zachycování a ukládání uhlíku a další technologie, které ministerstvo zrušilo, zahrnují téměř 332 milionů dolarů na projekt v rafinérském komplexu Exxon Mobil (NYSE:XOM) v Baytownu v Texasu, 500 milionů dolarů na společnost Heidelberg (ETR:HDDG) Materials v Louisianě a 375 milionů dolarů na společnost Eastman Chemical Company (NYSE:EMN) v Longview v Texasu.

Cena pro Baytown měla snížit emise uhlíku tím, že umožní použití vodíku namísto zemního plynu k výrobě ethylenu, suroviny používané k výrobě textilií a plastových pryskyřic.

Ministerstvo uvedlo, že téměř 70 % cen bylo podepsáno mezi 5. listopadem 2024, dnem voleb, a 20. lednem, posledním dnem Bidenova funkčního období.

Společnosti na žádosti o komentář okamžitě nereagovaly.

The pair is oscillating within a narrow range below 0.8630, balancing near five-month lows without a clear direction. Investors are holding back from taking aggressive positions ahead of decisions from the ECB and the Bank of England on Thursday, as markets are pricing in stability in key rates.

The ECB will likely keep the deposit rate at 2%, relying on Eurozone inflation remaining close to the 2% target, while expecting a slowdown in overall inflation due to base effects in energy, which the central bank sees as a transitory factor. Focus will be on the preliminary HICP for January, published on Wednesday: consensus forecasts annual overall inflation at 1.7% (year-on-year, compared to 1.9% in December) and core inflation at 2.3%, which is likely to reaffirm the pause in monetary adjustments without hints of imminent changes.

The Bank of England is also expected to keep the rate unchanged at 3.75%, as the effects of the December 25-basis-point cut have not yet been fully realized in the real economy. At this meeting, the central bank confirmed that monetary policy is on a path of gradual easing. However, renewed inflationary pressure in the UK, with the CPI in December rising by 3.4% year-on-year compared to 3.2% in November, complicates the trajectory for further rate reductions and prompts increased vigilance.

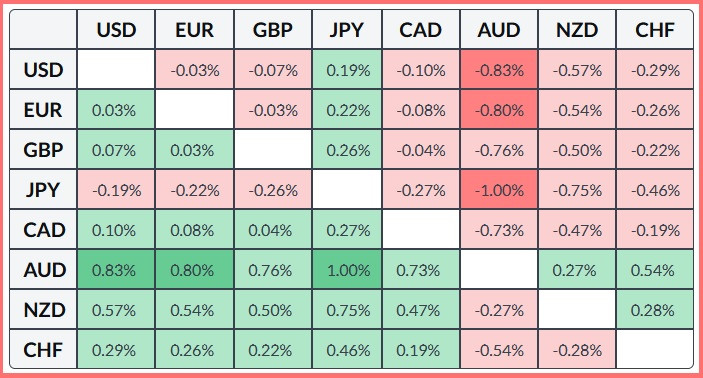

As a result, the EUR/GBP pair is consolidating at a five-month low while awaiting specifics on monetary policy: any discrepancies in the rhetoric from the ECB and the Bank of England could set an intraday momentum for the pair. In the table below, the dynamics of the euro against major currencies on Tuesday show that the euro demonstrated the most strength against the Japanese yen.

From a technical standpoint, the drop below the 200-day SMA favors bears, and a decline below the five-month low further weakens the pair. If prices cannot return above the 0.8630 level, they will accelerate the decline towards the 0.8610 level, heading for the round number 0.8600.

Oscillators on the daily chart are negative; however, the relative strength index is close to oversold territory, suggesting a consolidation or correction in the pair. If prices manage to return above the five-month high, they will aim for the 0.8650 level, where the 200-day SMA is located.

QUICK LINKS