Někteří vedoucí pracovníci společnosti Tesla (NASDAQ:TSLA) byli loni znepokojeni, když Elon Musk popřel zprávu agentury Reuters, že společnost zrušila plánovaný zcela nový elektromobil za 25 000 dolarů, od kterého si investoři slibovali explozivní růst prodeje vozidel, tvrdí lidé obeznámení s touto záležitostí.

„Reuters lže,“ napsal Musk na X několik minut po zveřejnění článku 5. dubna 2024, čímž zastavil 6% pokles akcií Tesly. Akcie Tesly po Muskově příspěvku část ztráty vyrovnaly, ale při uzavření trhu byly stále o 3,6 % nižší.

Vedení společnosti vědělo, že Musk ve skutečnosti zrušil výrobu levného vozidla, které mnoho investorů nazývalo Model 2, a zaměřil se na vývoj autonomních robotických taxi, uvedly zdroje. Společnost informovala zaměstnance o ukončení projektu již několik týdnů předem, uvedla agentura Reuters s odvoláním na tři zdroje a dokumenty společnosti.

Muskovo sdělení bylo pro některé vedoucí pracovníky natolik matoucí, že se ho zeptali, zda změnil názor. Musk jejich obavy odmítl a řekl, že projekt je stále mrtvý, uvedly osoby obeznámené s touto záležitostí.

Obavy vedoucích pracovníků, o kterých se dosud neinformovalo, vrhají světlo na snahu společnosti dodávat levné elektromobily pro masový trh, což je považováno za základní slib společnosti.

Někteří další vedoucí pracovníci Tesly se Muskovým příspěvkem na X nezabývali, uvedly osoby obeznámené s touto záležitostí. Automobilka udržuje své produktové plány flexibilní, aby mohla reagovat na podmínky trhu, uvedl jeden z nich.

Markets do not want shocks; they need stability. Even if Kevin Warsh is perceived by investors as the most hawkish candidate for Fed chair among the options, he is likely to defend central bank independence, which reassures traders. Combined with positive US macro data and upbeat news from Apple, this has pushed the S&P 500 closer to record highs.

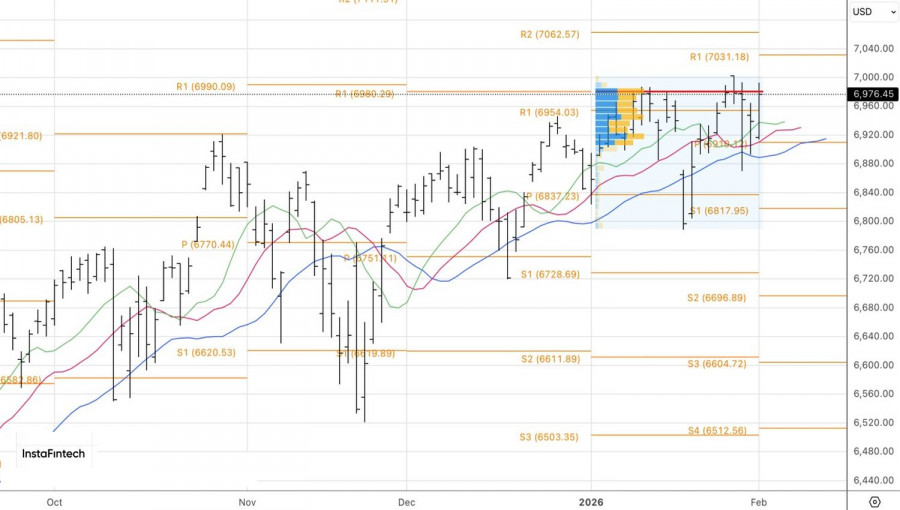

Dynamics of US equity indices

According to Barclays research, since 1930, the arrival of a new Fed chair has been followed, on average, by declines in the broad index of about 5%, 12%, and 16% over the first one, three, and six months, respectively. Markets seem to test new central bank chiefs, so we should expect elevated turbulence even with Kevin Warsh.

By contrast, Wells Fargo believes he will in fact prove to be a dove rather than the hawk markets currently expect. The bank projects two interest rate cuts in 2026, in line with derivatives pricing. In theory, a resumption of an easing cycle should support the S&P 500.

In reality, stability matters more to markets. Warsh is seen as someone capable of reversing the "sell America" trend by restoring confidence in both the Federal Reserve and the US dollar.

Foreigners hold roughly 21% of US securities by market value — and that figure exceeds 30% for US Treasuries. A broad sell?off by non?residents could be catastrophic for both the market and the US economy.

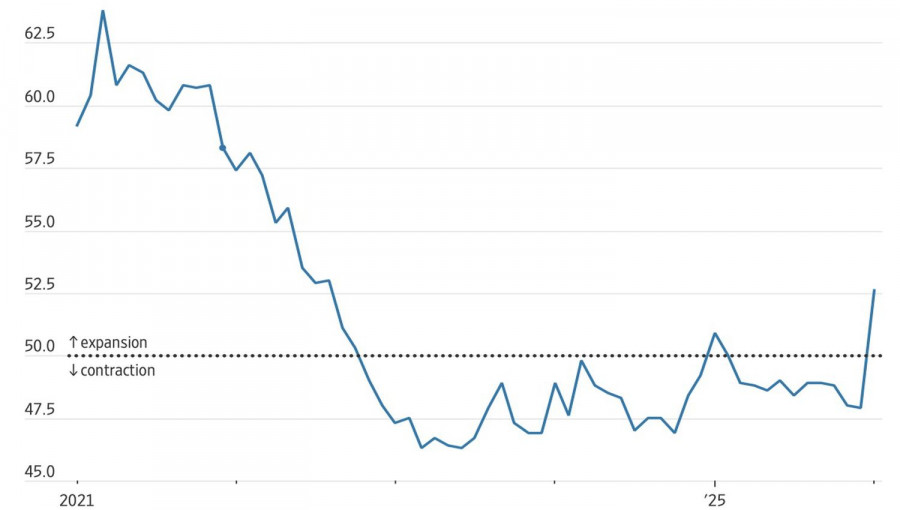

Dynamics of US manufacturing activity

As long as the US economy continues to show positive signals, equity indices should be fine. In this respect, an increase in the manufacturing PMI to the highest level since August 2022 came as a welcome surprise for S&P 500 supporters. For the first time in over a year, business activity in this sector exceeded the critical 50-point threshold, signaling expansion.

The rally in US equities was further fuelled by Apple's strong Q4 report, which lifted the stock by 4%. Markets also welcomed news that the White House cut tariffs on India from 25% to 18% in exchange for a halt to purchases of Russian oil. Traders were able to deploy the TACO strategy (Trump Always Chickens Out) and buy the dip.

A bitter note in the pot of honey was another government shutdown. Investors, however, expect it to be short?lived.

Technically, the daily chart shows that the S&P 500 has formed an inside bar. Long positions initiated near its upper boundary around 6,965 can be scaled up if a new local high at 7,000 is reached. The initial upside target for buyers is 7,140.

QUICK LINKS