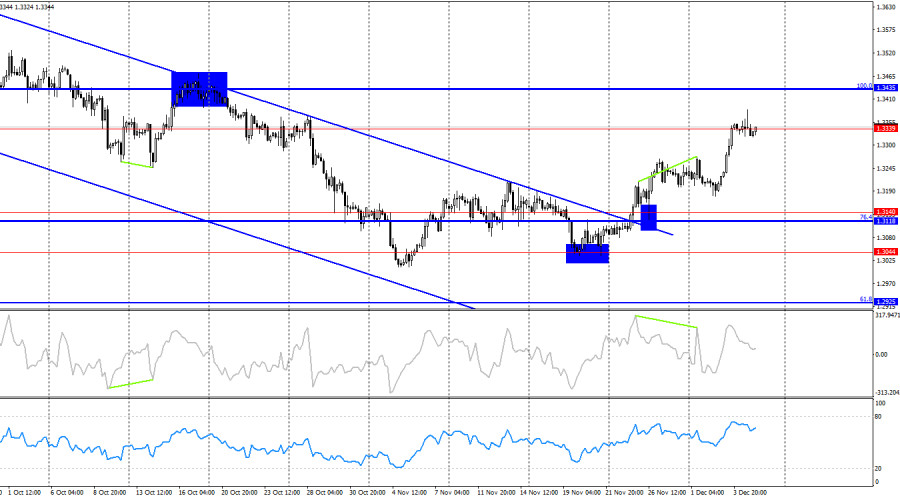

On the hourly chart, the GBP/USD pair bounced off the resistance zone of 1.3352–1.3362 on Thursday, then reversed in favor of the US dollar, posting a slight decline. Trader activity was very low due to a weak informational backdrop. On Friday morning, the pound is aiming to return to the 1.3352–1.3362 zone. A new bounce from this zone will once again favor the US dollar and lead to a decline towards the 61.8% corrective level at 1.3294. A consolidation above this zone will increase the likelihood of further growth towards the 1.3425 level.

The wave situation has transformed into a "bullish" stance. The last completed downward wave did not break the previous low, while the new upward wave easily broke the prior peak. Thus, the trend has changed to "bullish." The informational backdrop for the pound has been weak in recent weeks, but bears have fully accounted for it, and the information coming from America is also lacking.

The informational backdrop for both the pound and the dollar has been very contradictory in recent weeks. Consistent news from the UK regarding the formation and approval of the budget for the next financial year has been circulating. Rumors suggested that Chancellor Rachel Reeves would resign if she failed to form a budget without tax increases. However, the budget has now been approved with tax increases, and since then, the pound has been rising. Nevertheless, in just two weeks, the Bank of England may decide to cut interest rates by 0.25%. Meanwhile, the Federal Reserve is definitely set to make such a decision next week. Economic data from the UK has been entirely negative recently, but there has been no positive news from the US either. This creates a situation where the currency with the less negative informational backdrop will rise. In my opinion, the dollar rose for two months against an equally negative backdrop. Now, we may see a reverse situation: the informational backdrop will be equally bad for both currencies, but the pound will strengthen to restore market equilibrium. I expect a close above the 1.3352–1.3362 zone.

On the 4-hour chart, the pair has consolidated above the downward trend range and the 1.3118–1.3140 zone, and is rising towards the 1.3339 corrective level. A bounce from this level will favor the US dollar and lead to a decline towards 1.3140. A consolidation above the 1.3339 level will allow for anticipating further growth toward the Fibonacci 100.0% level at 1.3435. No new developing divergences are currently observed.

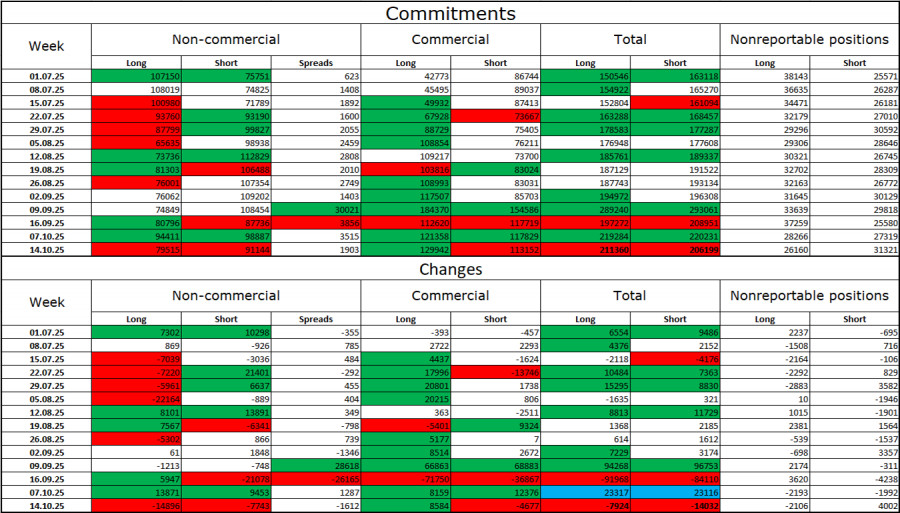

The sentiment of the "Non-commercial" trader category became less "bullish" over the last reporting week, but this report is from a month and a half ago, dating back to October 14. The number of long contracts held by speculators decreased by 14,896 units, while short contracts decreased by 7,743 units. The gap between long and short contracts stands at approximately 79,000, compared with 91,000. However, this data is from mid-October.

In my opinion, the pound still appears less "dangerous" than the dollar. In the short term, the US currency is in demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp decline in the labor market, and the Fed is forced to implement monetary easing to stop rising unemployment and stimulate job creation. Thus, if the BoE can cut rates once more, the FOMC may continue easing throughout 2026. The dollar weakened significantly by the end of 2025, and 2026 may not be much better for it.

On December 5, the economic calendar includes three average significance entries. The impact of the informational backdrop on market sentiment will be present but only in the second half of the day.

Short positions on the pair can be considered today when the pair rebounds on the resistance zone 1.3352–1.3362 on the hourly chart, targeting 1.3294. Longs can be opened from the hourly chart bounce off the zone 1.3186–1.3214 with targets of 1.3294 and 1.3352. Both targets have been reached. New longs should be initiated upon closing above the 1.3352–1.3362 zone with a target of 1.3425.

Fibonacci level grids are structured from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.